منصتكم للتغيير الايجابي

منصتكم للتغيير الايجابي

برامجنا المميزة

برنامج سياسات العراق

برنامج سياسات العراق

منصة المناخ

منصة المناخ

برنامج الاصلاحات الاقتصادية

برنامج الاصلاحات الاقتصادية

تعزيز مهارات الاكاديمين

تعزيز مهارات الاكاديمين احدث الاخبار والأنشطة

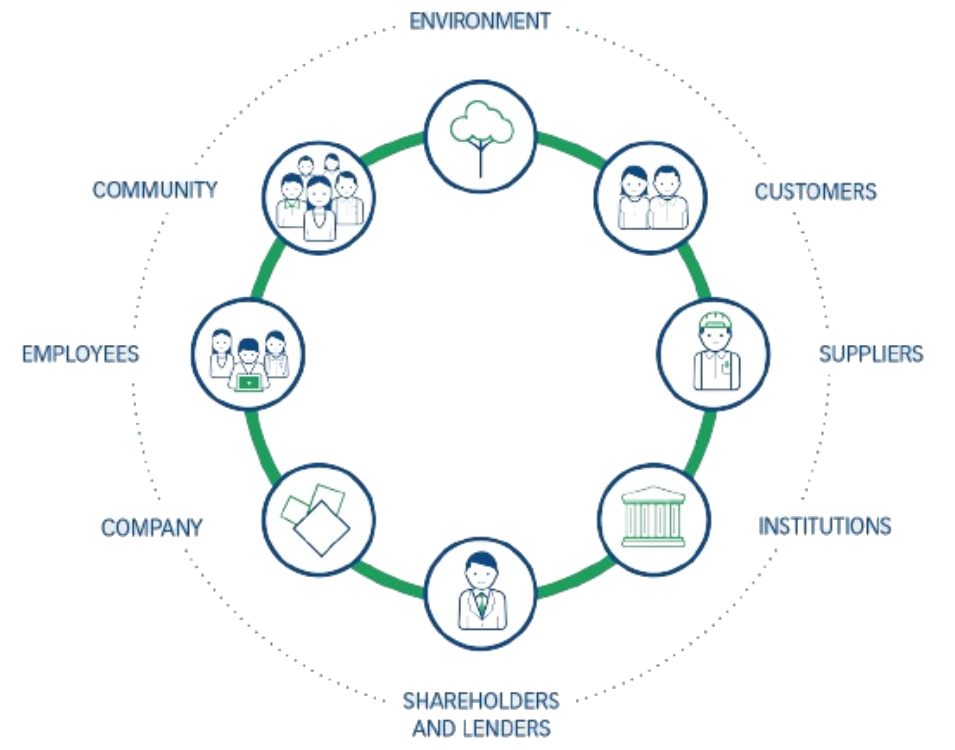

قيمنا الأساسية

روح الفريق نحن نؤمن بأن العمل معًا رغم اختلافاتنا سيساعدنا في العثور على العديد من الفرص لدعم السياق العراقي من خلال الحوار، وورش العمل، والندوات، ومجموعات التركيز.

روح الفريق نحن نؤمن بأن العمل معًا رغم اختلافاتنا سيساعدنا في العثور على العديد من الفرص لدعم السياق العراقي من خلال الحوار، وورش العمل، والندوات، ومجموعات التركيز.  التسامح نعتقد أن دعم الآخرين وإعطائهم مساحة لمشاركة أفكارهم هو المفتاح لتعزيز السلام في العراق من خلال التنوع، والحياد، والموضوعية، والمثابرة.

التسامح نعتقد أن دعم الآخرين وإعطائهم مساحة لمشاركة أفكارهم هو المفتاح لتعزيز السلام في العراق من خلال التنوع، والحياد، والموضوعية، والمثابرة.

ريادة الأعمال نحن نؤمن بدعم الشباب وتمكينهم من خلال الابتكار والإبداع، المبادرة والقدرة على التكيف، المخاطرة والنمو، ومشاركة الموظفين.

ريادة الأعمال نحن نؤمن بدعم الشباب وتمكينهم من خلال الابتكار والإبداع، المبادرة والقدرة على التكيف، المخاطرة والنمو، ومشاركة الموظفين.

الشراكة نحن نؤمن بأن التعاون والتنسيق هما المفتاح للنجاح بفضل المهارات والخبرات المكملة، اتخاذ القرارات المشتركة، تبادل الموارد، والتحفيز والدعم.

الشراكة نحن نؤمن بأن التعاون والتنسيق هما المفتاح للنجاح بفضل المهارات والخبرات المكملة، اتخاذ القرارات المشتركة، تبادل الموارد، والتحفيز والدعم.

تعرف على زملاء المركز

من كافة البرامج

تعرف على زملاء المركز

من كافة البرامج

الاداء الرقمي

تركيزنا تركيزنا

تركيزنا تركيزنا